A looming industrial land shortage on the Gold Coast is tipped to push property prices even higher. A report by Colliers International shows the amount of industrial land available for development on the Gold Coast has hit an all-time low with only 34ha of net land supply available for purchase in the Yatala industrial area, which equates to less than seven months’ of supply. Colliers industrial director Daniel Coburn says the scarcity of land and built product in core precincts is leading to capital and rental growth across all precincts. “However, because development opportunities in core markets are becoming harder to find, businesses are increasingly moving further north of the city which has led to the rapid absorption of the limited supply of land in the Yatala Enterprise Area over the past two years.” While it’s bad news for those after a site, Coburn says it is good news for investors already in the market as yields and capital values are increasing.

Decision Needed On GC Stadium

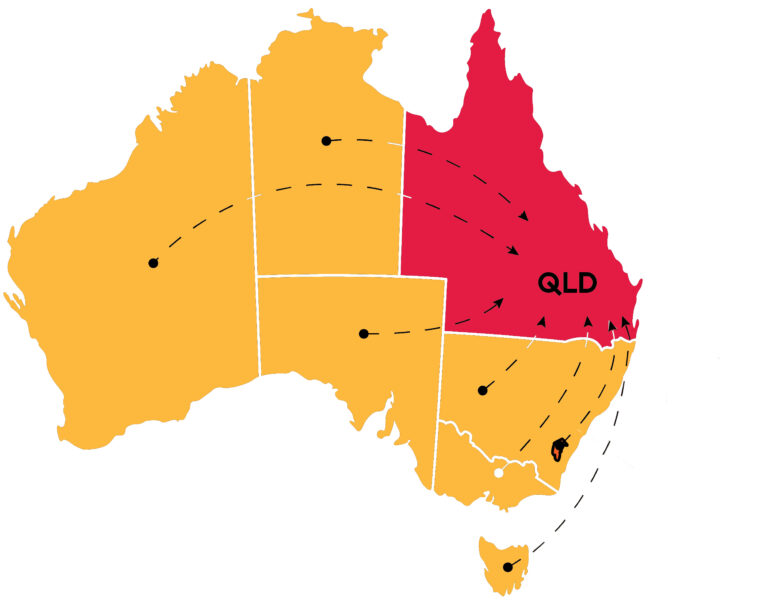

Interest is starting to build for a new indoor stadium on the Gold Coast. Many believe the current Gold Coast Convention and Exhibition Centre needs an upgrade or a new stadium to meet demand for big events and concerts. In 2019, the State Government was considering developing a global tourism hub on the Gold Coast which would provide larger convention spaces and entertainment facilities. A report into its viability at the time says without it “it is likely the Gold Coast will continue to lose market share, and the economic returns it brings, unless significant change is made.” At the time the owner of the Star Casino offered to invest up to $100 million to expand the Gold Coast Convention and Exhibition Centre, but the proposal did not proceed. The Gold Coast Bulletin quotes an entertainment industry insider labelling it a “joke” that as the second largest city in Queensland there is not a stadium suitable for big overseas touring acts

Quote of the Week

“The reason (stamp duty) is such a problem for older women in particular is because when you are 45 or 50 you may only have 15 years left in the workforce – you will find it very hard to purchase a home and pay off the loan including the stamp duty by the time you retire.”

Brendan Coates, Grattan Institute

Auction Market Strong Again

The auction market is continuing to perform well, with clearance rates surpassing 70% for the second week in a row. CoreLogic figures show the national clearance rate hit 74.4% last week across the combined capital cities. Adelaide had the highest clearance rate of 80.8%, followed by Sydney, 76.2% and Melbourne, 75.7%. Canberra’s clearance rate was 77.2%, followed by Brisbane, 56.5%. CoreLogic says auction volumes were low with 1673 homes going under the hammer last week, which was 42% lower than the same time last year. It says the lack of stock coupled with unprecedented population growth and the rental crisis is creating a sense of Fear Of Missing Out in the market, which is helping to drive prices higher. As a result, CoreLogic’s daily dwelling values index has rebounded 2.2% from its February low across all major capital cities. Sydney had the highest value increase of 3.8%, followed by Perth, 1.7%, Brisbane, 1.3%, Melbourne, 0.9% and Adelaide, 0.3%.

Hidden Cost In Divorce

Stamp duty has a huge impact on divorced women, a parliamentary inquiry has been told. The Grattan Institute’s Brendan Coats told the inquiry only 34% of separated women manage to own a home again within five years and 44% within 10 years. “The reason that it’s such a problem for older women in particular is because when you are 45 or 50 you may only have 15 years left in the workforce – you will find it very hard to purchase a home and pay off the loan including the stamp duty by the time you retire,” he says. REA Group CEO Owen Wilson says stamp duty costs lead to traffic congestion, stops labour mobility and shuts first home buyers out of the market. “The significant cost of stamp duty deters downsizers and locks people into homes that don’t suit their needs,” Wilson says. People won’t move closer to a new job and instead accept a long commute as opposed to the cost of moving

Cheap Loans For Power Switch

Homeowners are being offered cheap loans to entice them to make their homes more energy efficient. The Federal Government will lend money to those who want to improve their energy efficiency by doing things such as installing solar panels or upgrading their water heaters. It has allocated $1.3 billion towards the Household Energy Upgrades Fund which it hopes will help 110,000 households lower their energy bills. The fund will also improve energy efficiency in social housing. With about 60,000 social housing properties expected to save up to one-third of their energy costs annually. The Property Council of Australia says the move will help slash energy bills and help move Australia closer to its net zero goal. Treasurer Jim Chalmers says the aim is to make sure energy bills are more affordable in the future. The loans will help fund double glazing, solar panels and other improvements which will make it cheaper to cool or heat homes and reduce emissions