The Queensland Government has announced plans to establish a Gold Coast community forum which will bring residents and government together to grow the local economy and access priority needs of the region. More than $4.4 billion in infrastructure spending has been earmarked for the Gold Coast region in the latest Queensland Budget. The aim of the funding is to improve connectivity, access to healthcare and housing support on the Gold Coast. Projects include; $2.3 billion invested in infrastructure, $2.1 billion for the Gold Coast Hospital and Health Service and $89.7 million to maintain, improve and upgrade schools. There will also be $65.7 million dedicated to expanding and improving social housing. About $1.3 billion will be spent on the new Coomera Hospital and $200 million on the Gold Coast University Hospital to deliver a Secure Mental Health Rehabilitation Unit. Following a Community Cabinet on the Gold Coast, Queensland Premier Annastacia Palaszczuk says the new community forum will meet before the end of the year.

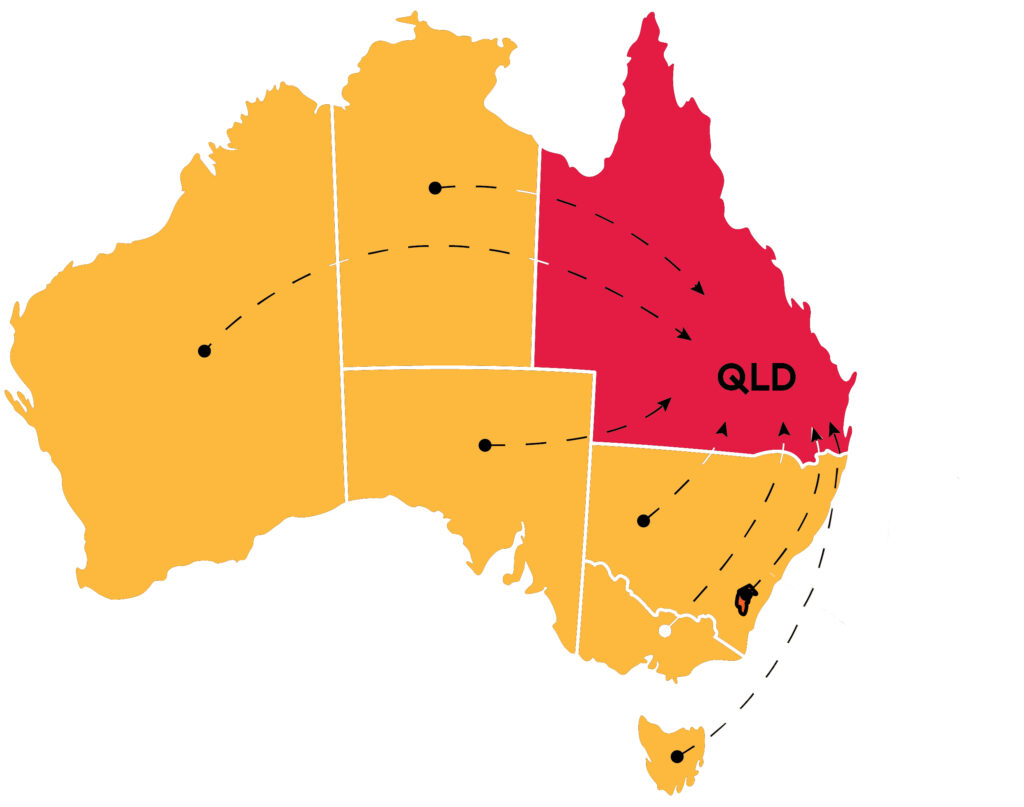

Everyone Wants To Live In QLD

Everyone wants to move to Queensland, with the state now the most sought-after place by interstate and overseas buyers and renters. The Little Hinges Sight Unseen Report, shows that the Gold Coast, Sunshine Coast and Brisbane are the most popular locations in the state. The Gold Coast chalked up the highest number of virtual property inspections in Australia, with 40% of interstate buyer inspections and almost 10% of overseas buyers looking at properties in the region. Almost 39% of interstate inspections and 7% of overseas inspections were for properties on the Sunshine Coast, while Brisbane attracted 23% of interstate inspections and 7% of overseas inspections. Melbourne and Sydney both had 14% of inspections from interstate buyers and 8% and 7% of overseas buyer inspections respectively. Mike York of Little Hinges says the number of people inspecting property virtually is increasing again. “The percentage of buyers inspecting property from interstate are at their highest levels since the start of the year,” he says.

Quote of the Week

“It’s important to know that rents have moved no more than inflation if we take into account the rent drops during Covid. For those two years the renters had a ball because many foreigners left and there was an immediate oversupply of rental accommodation.”

Harry Triguboff on the constant attacking of investors

Price Predictions Change

NAB has joined the ranks of organisations revising their property price predictions for 2023. While initially it had not been as bullish, its latest outlook now predicts prices will rise by 4.7% this year and a further 5% in 2024. It predicts the biggest increases will be in Sydney, up 6.9% this year and 4.9% next year, while it says Melbourne is likely to rise by 2% this year and 7.4% in 2024. Brisbane prices are tipped to rise by 5.4% this year and 2.9% next year, while Adelaide values are tipped to rise 3% this year and 3.7% in 2024. Perth prices are expected to rise 6% this year and 6.2% next year, while Hobart prices are expected to rise 6.4% this year and remain steady in 2024. The bank is also predicting that interest rate rises will soon stop. “We see the RBA lifting rates to 4.6 per cent by September, then staying on hold until 2024,” the outlook says.

Property Prices Rise

Capital city house prices are continuing to recover with dwelling values up in Sydney, Brisbane, Adelaide and Perth in the June quarter. Real Estate Institute of New South Wales president Pete Matthews says all population centres showed increases in average dwelling values by more than 2%. He says both the renter and sales market are “savagely affected” by a lack of stock. “I’ve never seen (anything like) it in 33 years,” Matthews says. He says Sydney, in particular, enjoyed “hefty” increases in dwelling values in the June quarter. CoreLogic figures show Sydney’s median dwelling value rose, 4.9% in the June quarter, Brisbane rose by 3% and Melbourne rose 1.8%. Adelaide’s median dwelling value rose by 2.1% in the June quarter, Perth, 2.8% and Hobart 0.1%. Darwin’s median dwelling value dropped by 0.3% in the June quarter, although it rose again by 0.5% in June. CoreLogic research director Tim Lawless says while housing values are continuing to increase, the pace of growth has eased a bit

Stop Threatening Investors

Attacking investors and threatening their ability to charge what rent they want, will not help fix the rental crisis, according to developer, Harry Triguboff. Triguboff, the managing director of Meriton Group, says the “hysterical” reaction to current rent rates has to stop. “Our famous politicians now think that if they attack the people who lease property, they will gain votes,” Triguboff says. “It’s important to know that rents have moved no more than inflation if we take into account the rent drops during Covid. For those two years, the renters had a ball because many foreigners left and there was an immediate oversupply of rental accommodation.” He says now the market is returning to normal supply and demand. “But if the government threatens investors daily that they will charge too much, what investor will ever come here?” Triguboff says the lack of investors means many of the sales in his projects are to owner occupiers. “So, the pressure is on for rents to rise.”