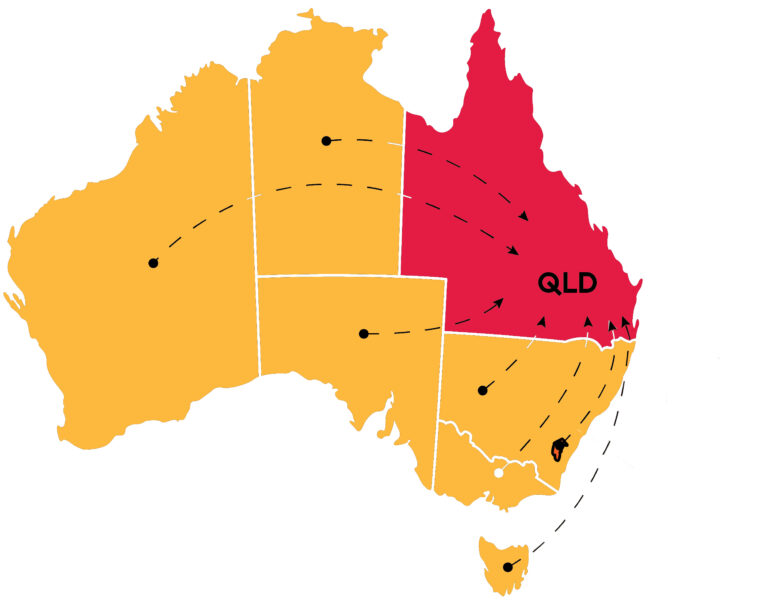

Queensland continues to lead the country for internal migration, with the Gold Coast and the Sunshine Coast the most popular destinations. The PropTrack Regional Australia 2022 Report found Queensland – both metro and regional – remained the top destination for internal migrants, with more people moving to the state than anywhere else in the nation. “The Sunshine State has experienced an unprecedented influx of new residents, with a net gain of 107,549 people in the past five years,” the report said. “When comparing the data from previous Censuses, a steady increase in the proportion of interstate migrants into both the Gold Coast and Sunshine Coast can be seen. “Gold Coast and Sunshine Coast suburbs account for more than half of the top 20 suburbs in regional Australia with the most potential buyers per listing and almost the entirety of the top 10.” But the biggest growth in demand per listing can be found in the Darling Downs-Maranoa (51%), Cairns (25%), Toowoomba (17%) and Mackay-Isaac[1]Whitsunday (17%).

SEQ Infrastructure Projects Cost Billions

The 2032 Olympics has bolstered Queensland’s infrastructure pipeline: 18 major projects costing over $500 million each are underway, according to the State Government. The plethora of major projects is set to underpin the region’s economy and property market for years to come. The Olympics preparations will add even more major projects. There are so many projects on the go, that the Government’s budgeted capital expenditure has increased from $9.9 billion in FY2019 to $12.6 billion in the FY2023 budget, which does not include the future projects associated with the Games. There are 11 projects with a budget above $1 billion in Queensland, headed by Cross River Rail, with a budget of $6.9 billion. The second most expensive project is the final stages of the creation of 75 New Generation Rollingstock electric trains. Third on the list is the faster rail upgrade from Kuraby to Beenleigh at a cost of $2.6 billion, while fourth, at $2.2 billion, is Stage 1 of the Coomera Connector.

Quote of the Week

“It’s been a year of two halves in the housing market. The first half was pretty good and the second part not so much. This looks set to be repeated in 2023, just in reverse. A housing speed bump if you ask me, not a cliff. If we have learnt anything over recent years, it is to ignore the talking heads. Things, housing wise, aren’t anywhere near as bad as most gasbags say they are.”

Veteran real estate analyst Michael Matusik, Matusik Property Insights

Most Expect Prices To Rise

Despite economists’ forecasts that house prices could fall as much as 20%, most Australians expect dwelling values to rise or stay steady in the next two years, according to Canstar. In its Consumer Pulse Report, 60% of respondents said they expected house prices to remain stable, grow or possibly even skyrocket in the next two years. Almost 30% expect prices to grow at a steady pace and 16% expect prices to “skyrocket at some point”, while 15% think prices will remain stable. Only 9% tip prices to crash. Canstar’s Steve Mickenbecker says the confidence Australians have in property prices is “surprising”, given that media has reported many forecasts of prices dropping. But buyers’ advocate Cate Bakos isn’t surprised by respondents’ stance compared to economists’ negative forecasts, as she believes consumers are less likely to buy into the media hype. “I don’t believe those negative predictions because they consistently get it wrong,” she says. “We saw predictions about an impending crash after Covid, and we had the opposite.”

Population Growth Returns In 2022

Australia’s population returned to strong growth in FY2022, following pandemic-affected 2021 when the population barely grew at all, thanks to border closures. ABS data shows the re-opening of international borders in early 2022 led to an increase in Australia’s population to 25,978,935 people in June, up 1.1% (291,000) on the previous year. “Glenn the Census Expert” of profile.id says this is still below the growth rates of between 1.5% and 1.8% recorded in the years prior to Covid, but it includes almost six months of the financial year when the overseas borders were still closed. “72% of that annual population growth occurred in the second half of the financial year (the first six months of 2022), once the borders were fully open,” he says. “Net overseas migration was 170,900. While it’s lower than in pre-pandemic years, it’s gone back to making up the majority (59%) of our population growth. The remainder is due to natural increase: more births than deaths.”

Unit Popularity Rising With FHBs

Apartment living is becoming more desirable as buyers make trade-offs to get into the market. More than half of wannabe first-home buyers hope to own a house in their desired location in the next five years, despite affordability constraints, new research shows. The Great Southern Bank survey of 1,500 people revealed 72% of respondents would consider buying a unit as an alternative form of housing. But just 24% would be willing to move to a less desirable suburb to buy their ideal home. Great Southern Bank chief customer officer Megan Keleher said trade-offs such as buying a townhouse or apartment, or moving “slightly further afield” could help buyers break in. She said first-timers could also consider the Federal Government’s Home Guarantee Scheme and Regional First Home Buyer Guarantee, where they can buy with as little as a 5% deposit. LongView head of advisory Warwick Brookes said it was important to discuss options with experts, which could include home loan specialists and buyers’ advocates