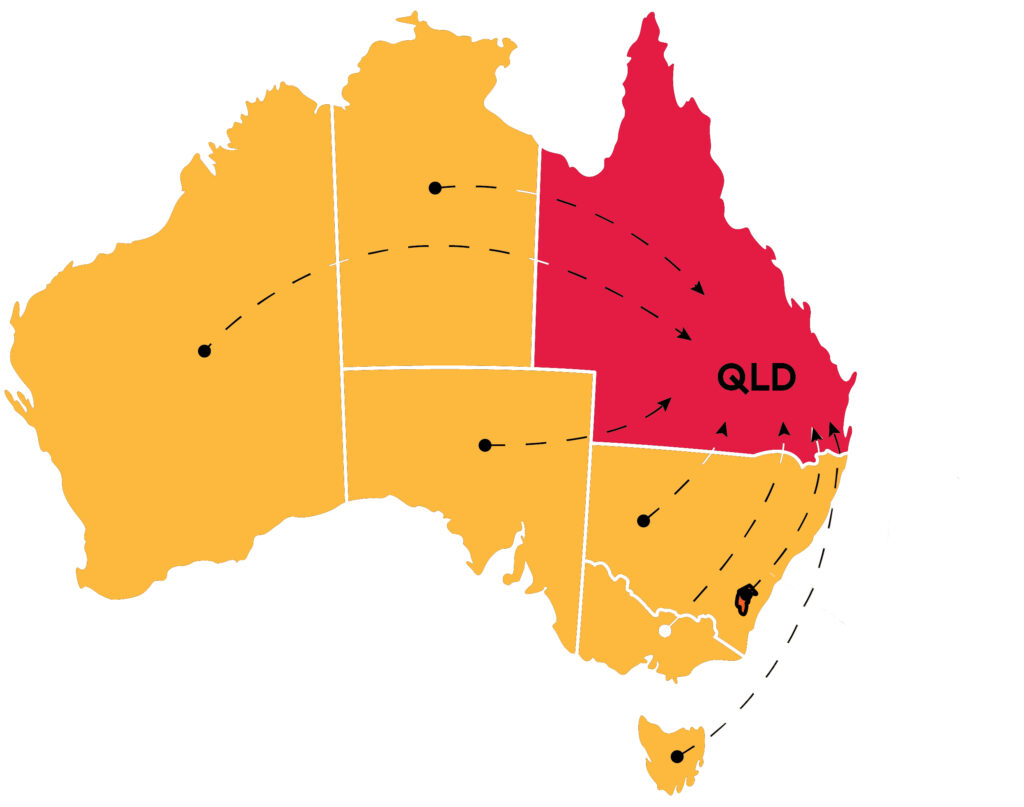

Interstate migration is continuing to drive Queensland property prices, with Real Estate Institute of Queensland (REIQ) figures showing robust results for the September Quarter. REIQ chief executive Antonia Mercorella says a number of factors are fuelling huge buyer demand. “Queensland hasn’t experienced this sustained level of demand and accelerated growth before, but after years of modest growth, prices here are playing catch up,” she says. During the quarter 3,912 homes sold in Brisbane City, followed by the Gold Coast with 2,419 sales, Moreton Bay Region 1,945 and the Sunshine Coast with 1,510. Logan also performed well with 1,413 houses sold and Ipswich with 1,366. “With cashed-up interstate buyers comfortable with auctions and able to snap up properties with competitive offers, it’s no wonder that interstate migration to Queensland is at an almost 20-year high, as southerners relocate here in droves,” Mercorella says. Brisbane’s median house price increased by 4.7% in the third quarter of 2021

Gold Coast Shack Fetches $5.4mil

Queensland coastal properties continue to be in strong demand with a fibro beach cottage on the Gold Coast changing hands for $5.4 million. The sale was for almost $500,000 more than another home in the same street just four months ago. Six bidders registered to vie for the property which had been owned by the same family for more than 60 years. Selling agent Troy Dowker of Kollosche Broadbeach says the successful bidder plans to build a new house on the 413sqm block which currently houses a three-bedroom one-bathroom shack on the beachfront at Palm Beach. Registered bidders included an overseas party and interstate buyers but it was a local who was successful. Dowker says in the lead-up to the auction he fielded 209 enquiries on the property. The previous sale in the street (Jefferson Lane) was for $4.975 million in August. Dowker says that was also a “cute little cottage” which sold via private treaty.

Quote of the Week

“There are plenty of areas of Australia represented among the new entrants to the million-dollar club … and that just goes to show how dramatically demand preferences have shifted through the Covid period.”

CoreLogic head of residential research Eliza Owen

392 Suburbs Join $Million Club

Thousands more home-owners are “on paper” millionaires with new data showing an additional 392 suburbs now have median prices above $1 million. CoreLogic figures show the number of suburbs tipping into the million-dollar median club more than doubled this year on the back of more than 20% house price growth in 2021. CoreLogic’s Eliza Owen says the high number of new additions to the club shows just how well the property market performed in 2021. “It’s really interesting to see areas that you wouldn’t think of as being million-dollar markets tipping over into that price point,” Owens says. “This isn’t the blue-chip areas. It’s areas that have traditionally been more working class or affordable.” NSW had the most new entries with 176 suburbs joining the list, many of them in south-west Sydney and the Central Coast. In Queensland 76 suburbs joined the list particularly in the south-east. Victoria gained 67 suburbs, Canberra 20, Perth 15 and Hobart 5

Household Wealth Hits Record High

Household wealth in Australia increased 4.4% in the September Quarter to hit a record $13,918.5 billion, according to ABS data. Wealth per capita also rose to a record high of $540,179, with residential property assets contributing 3.5% to the growth in the quarter. Increases in superannuation balances and in currency and deposits also helped improve household wealth. ABS Head of Finance and Wealth Katherine Keenan says residential property prices increased by 5% during the quarter. “Lockdown restrictions in NSW, Victoria and the ACT reduced auction volumes and property listings in those markets,” she says. “However, property prices continued to grow strongly.” Keenan says Government support during the pandemic has also helped increase household disposable income. At the time household spending dropped, particularly in NSW, Victoria and the ACT as those cities experienced prolonged periods of lockdown restrictions