Seeing as capital growth is one of the main reasons to invest in residential property, it is understandable that many want to know how long it is going to take for the value to increase. Many experts often tell you that when investing long term, the average annual growth rate for well-located capital city properties is generally 7%. This would mean properties should double in value every 10 years. But, the truth is… some do and some don’t.

What Does Property History Say?

If what happened in the past happened again over the next decade, figures suggest that 50% of properties will not double in value and 50% will grow in value more quickly. However, currently we are experiencing lower inflation times with lower interest rates and lower wages growth. Taking this into account, it is unlikely that we will see the same level of price growth.

What Does This Mean for Australia’s Future Property Prices

OK, so there’s been a lot of chatter recently about the Sydney property market having lost some ground, but the reality of this is that it’s simply experiencing a ‘soft landing’ after a number of years of unsustainable growth. The same can be said of the Melbourne property market. It’s nothing to panic over, property markets are naturally circular. Let’s take a look at some past figures, which can help us to predict future pricing:

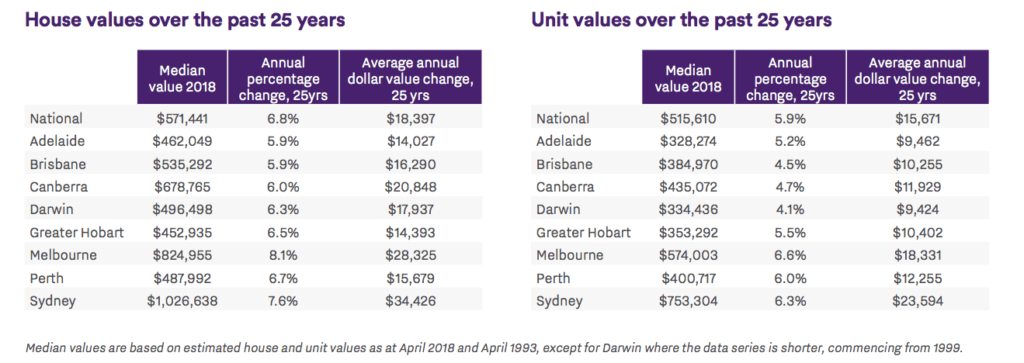

Nationally the median house value experienced an annual growth rate of 6.8% over the last 25 years, according to CoreLogic research correlated by Aussie. In a quarter of a century, the median house value has increased by 412% from $111,524 to $459,900.

Apartments experienced an annual growth rate of 5.9%, having increased in value by 316% since 1993. In 1993, the median house value across Australia was $111,524, but apartments median value was slightly higher at $123,840.

Source: Aussie.com.au

There are of course markets within markets, some by geography or by price point and some by the type of property. It is why it can be difficult and sometimes incorrect to use capital growth figures for a city like Sydney or Melbourne. It can sometimes lead to broad conclusions. And again…

Property Markets Are Cyclical

What this means is that each Australian state experiences its own property cycle. If you do your research, you will generally find that in each 10-year period there is a three to four year period where the market either flattens out or falls. Then, there is a three to four year period of low capital growth, followed by another three to four year period of strong growth in what’s commonly called the ‘boom’ stage of the cycle.

So, How Long Does It Take for The Value of a Property to Double?

It’s important to remember, location does most of the money work for you. It is essential to buy in the right location, because location will do about 80% of the work in raising your property’s capital growth. There is much research dedicated to capital growth, with many property and finance experts confirming that, in general, capital growth is greater in Australia’s capital cities than in regional areas.

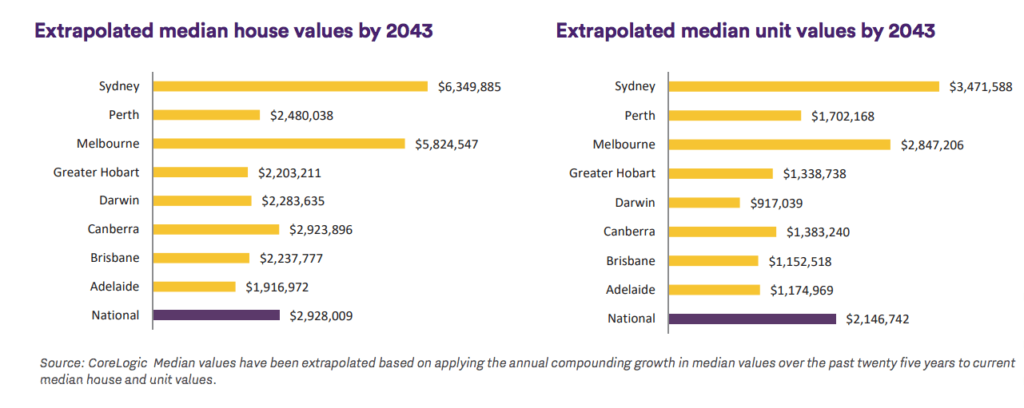

Past performance isn’t always a perfect indicator of future performance, as housing trends are likely to change. But, if property prices were to rise in the future at exactly the same rate as the past 25 years, here is what figures forecast according to Aussie.

These figures predict the national median values will increase to $2.9 million for houses and $2.1 million for units over the next 25 years. Keep in mind, these figures don’t and can’t account for the many economic, demographic and political variables that will make an impact over these years.

To sum up, everyone hopes to buy just before the boom and expects it to last forever, just as everyone loses confidence in the downturn. But, just remember what we’ve said about property being cyclical. If you hold onto your investment long enough and can last through the down times, it will increase in value. It’s why we always say, property investment is a long-term strategy and you need to be thinking long-term to make money.